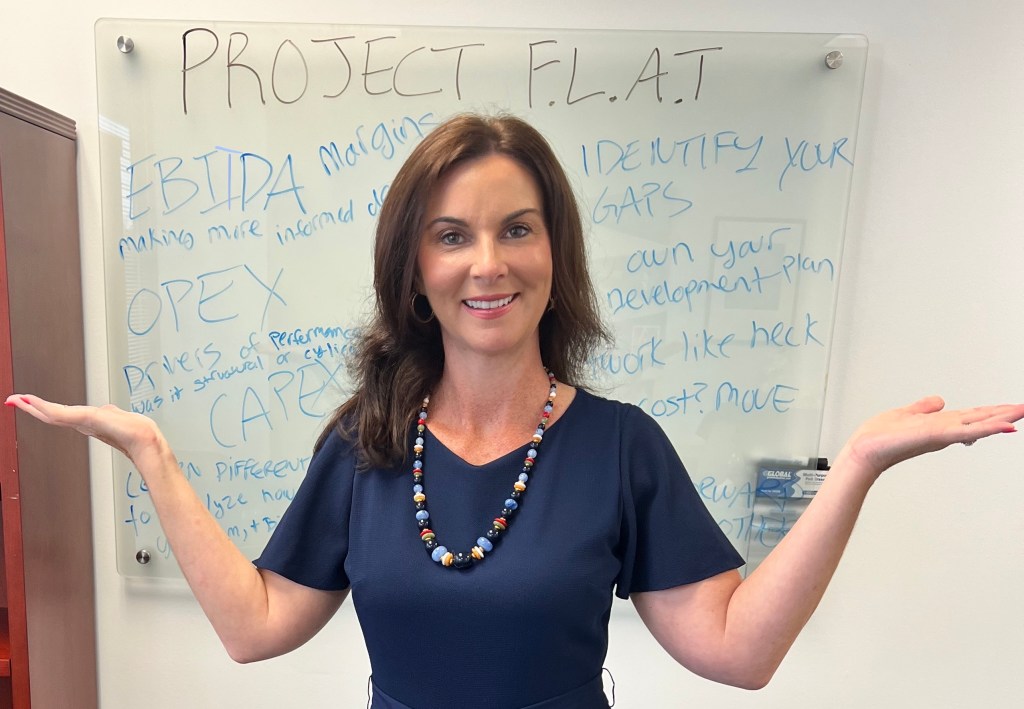

What the heck is “Project FLAT”? It’s the very specific self-authored professional development plan I put myself on during a pivotal growth moment in my career– It stands for Financial Literacy Advancement Training (to get excited, I had to market it to myself). Since I care deeply about mentoring others and talent development in general, I thought I’d share my personal journey and freely hand out the actual plan I created and followed.

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

My Role Then and Now

In case I need a little street cred – I was the SVP of Operations for a global EdTech & Professional Services business (a division COO within a publicly traded company). I’ve led through a 4.5X scale (organic and inorganic growth). Back in 2020, I advanced to that senior executive role where I oversaw the functional areas across the full Student Lifecycle: marketing, enrollment, retention/student advising, product, academic services, operations, and change management (7 functions, 800+ colleagues, 55 job functions). Prior to that role, I was VP of Marketing leading a department of 150 people across 18 marketing disciplines. Today, I’m a Chief Business Officer (transitioned from Chief Marketing Officer. I oscillate from a CBO, COO, or CMO – all just depends on the particular opportunity and my skillset fit relative to what the organization needs at particular point in time. Even when I was in pure marketing, I was always a “moperator” – a marketer obsessed with the operations behind it.

In all 3 of those roles, I have been lucky enough to be surrounded by highly effective, really great talent (one of the keys to any successful business).

So how did I make the transition from head of marketing to an executive operations role at the senior level and then on to the C-suite? With all of this in the rear-view, I can reflect and look back at the steps:

- Identify your gaps

- Own your professional development

- Do. The. Work.

- Network like crazy along your learning journey

- Apply your learns along the way and let others know what you’re working on

- Pay it forward with your new (or old) domain of expertise

- Don’t stress about the sunk cost fallacy if you want to change course down the road

I am going to break down each of the steps and share exactly what I did

I’m also freely handing out the actual plan I created and followed. One of the things I love is when others who have ‘been there done that’ share some of the real-life resources and artifacts that led to their success (whatever the domain is). It demystifies things. Earlier in my career, I wondered how executive leaders got to where they were. Did they still do development plans? Did they still have skills gaps at that level? If so, what did they do about it? How the heck did they all seem to speak finance?

There’s a bajillion paths to get here, this is mine.

1. Identified My Gaps

Why FLAT (Financial Literacy Advancement Training)?

Back in 2020, I self-identified the need to “flatten my own learning curve” so to speak – particularly focused on financial literacy and acumen. It’s also a metaphor for “leveling the playing field”, giving me the same chance of succeeding in rooms/situations where there’s an established common language and laser focus on financial matters. Get it? FLAT. (let her have it, she thinks she’s clever with the pithy acronym.)

Rather than change management, team leadership, customer-centricity, organizational savvy, problem-solving, or the marketing and technology disciplines, I chose to focus development on advancing my financial literacy, with the supposition that the other areas already had a proven track record of high competency.

What’s your operating profit margin and what’s increasing your COGS? Huh? Say what?

When highly successful (non-finance) employees are promoted to positions of executive leadership, it is sometimes assumed that they suddenly understand the new rung of financial information being provided to them. That’s typically not true (The Dismal Financial IQ of US Managers, HBR.org). You don’t suddenly wake up one morning and speak EBITDA. But, it’s the language of business and if you want a reach a certain level, it’s a domain you may need to upskill.

Self-Assessment

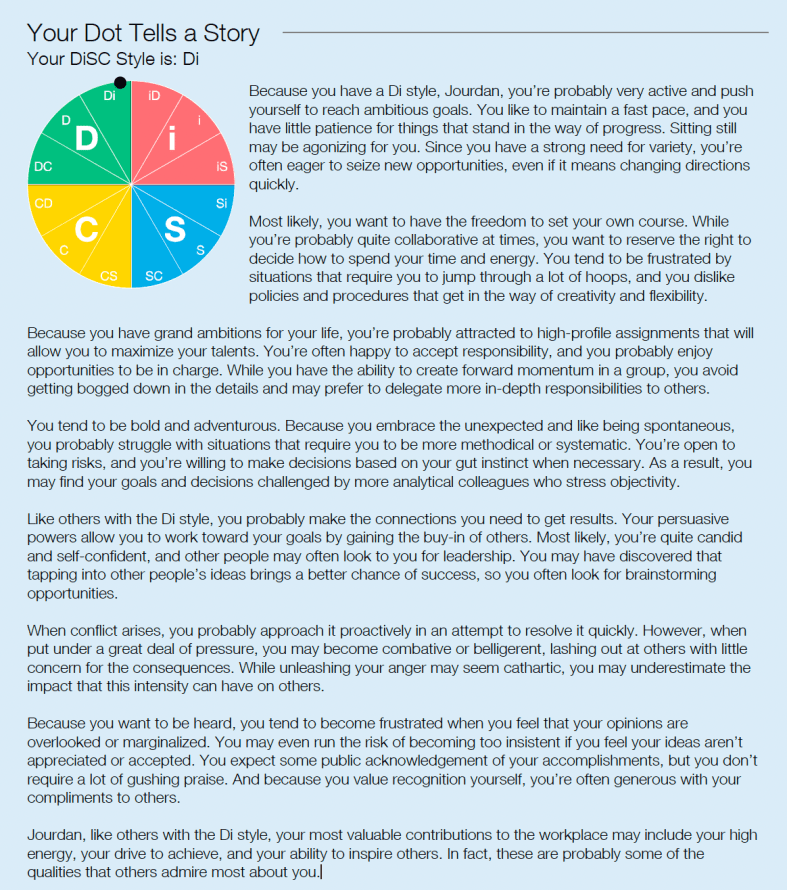

I did a self-assessment of my financial literacy and acumen and figured I was squarely at stage 2.

- Stage 1: Unconsciously Incompetent “I don’t know what I don’t know.”

- Stage 2: Consciously Incompetent “I know what I don’t know.”

- Stage 3: Consciously Competent “I grow and know and it starts to show.”

- Stage 4: Unconsciously Competent or Mastery “I simply go because of what I know.”

Factor 1: Thought | Cluster A: Understanding the Business | Competency 17: Financial Acumen Korn Ferry Leadership Architect™ Global Competency Framework (Book: FYI For Your Improvement)

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

2. Own Your Professional Development

I put together this document which contained my Professional Development Plan. I wanted to create a roadmap containing the skills, actions, and conscious intentionality needed to further myself in my career (and life) to achieve my professional goals. My aim with this plan was to consciously work on developing myself so I could advance my higher-level competencies; and subsequently, the application of them to further our organization’s goals (professional development ideally advances yourself AND the business you are working for).

I also got really clear on the benefits that I was seeking with all of this:

Non-finance leaders, regardless of their primary domain of expertise, can significantly benefit from gaining a fundamental understanding of finance for quite a few reasons:

- Decision Making: Financial acumen will allow me to make informed decisions that consider both the strategic and financial implications of my choices. I’ll be able to evaluate projects and initiatives not only in terms of their qualitative value but also in terms of ROI, payback period, and NPV (had to learn what the heck that means), among other financial metrics.

- Resource Allocation: As a leader, I often must decide how to best allocate resources within my teams or departments. Understanding financial concepts can help me have another lens to prioritize projects or initiatives that offer the best financial returns.

- Budgeting and Forecasting: Non-finance leaders are typically responsible for their department’s budget. Understanding how to create, manage, and forecast budgets is essential to ensuring my department remains financially viable and aligned with our broader business goals.

- Communication with Finance Teams: Having a basic understanding of financial principles will enable better communication with the finance department. It will allow me to understand and justify budget requests, interpret financial reports, and actively participate in financial discussions in a more substantive way.

- Strategic Planning: Financial literacy is integral to strategic planning. With a deeper financial understanding, I could better align the department’s strategies to our financial goals, ensuring congruence and maximizing my department’s contribution.

- Risk Management: Financial knowledge helps in assessing the financial risks associated with various decisions. This will help with my decision-making in taking informed risks or creating strategies to mitigate potential downsides.

- Enhanced Credibility: When I upskill in this area and demonstrate a grasp of financial concepts, I’ll inherently broaden my credibility. I’ll become a more well-rounded professional who understands the broader business context.

- Career Advancement: As professionals climb the corporate ladder, a broader skill set that includes financial acumen becomes increasingly important. To continue elevating, I’ll need to understand the financial health of the entire organization, even if my primary expertise lies elsewhere.

- Stakeholder Engagement: From QBRs to earnings prep, I engage with many different stakeholders. While I know the marketing numbers fluently, being conversant in finance will help in communicating the value props, project ROIs, and financial stability of projects.

- Holistic Business Understanding: I’m keenly aware that finance is the language of business. To understand our business holistically, I need to appreciate how different functions interact and contribute to the bottom line. Financial knowledge provides a lens to evaluate these interactions.

Upskilling Myself with Project FLAT (Financial Literacy Advancement Training) will aid in making more effective decisions and will foster a comprehensive understanding of the business, enabling me to contribute more significantly to our overall success.

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

3. Do. The. Work.

My goal was not to become a finance expert, but rather to understand finance and how to incorporate a financial thinking lens into every major decision made. Practically speaking, I made a self-paced, time-bound, set of development activities and then literally put each of these things on my calendar. Every description said: “Project FLAT daily non-negotiable calendar block”. Did I always do them exactly when planned? Nope, but I never went to bed before I did the work (ok, not never, but nearly never). 70% of the time, I adhered to my prescheduled time blocks for this. Sometimes this meant I brought my laptop to my daughter’s volleyball tournament and completed coursework on breaks. Sometimes I had to get up really early and bang out some reading. Sometimes I had to switch out Pearl Jam on my earbuds while working out in favor of finance podcasts (not sure those workouts were very hype lol). It goes without saying I am not suggesting you run yourself into the ground nor should you miss your kid’s middle block in a weekend tournament because you prioritized your job – no way – I just mean that you’ll make ⏲ time for what you prioritize. Find whatever works for you. Key takeaway: you’ll make time for what you prioritize.

What work?

Articles, books, decks, earnings calls, P&L reviews, more P&L reviews, then some more P&L reviews, online courses, mentor sessions, formal and casual “can you help me” meetings, more P&L reviews (at one point unfamiliar, but now status quo), certificate credentialing programs, memos, random questions to clarify a term or concept (a bajillion of those) – do the things. No way of getting around it. Do. The. Work.

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

4. Network Like Crazy Along Your Learning Journey

Looking back, if I had to pick the most useful/impactful learning mechanism, what would it be?

Which learning asset gave me the most bang for my buck?

Did I learn the most from all the articles and books I read? Was it the certificate program I completed? Was it learning how to assemble and analyze QBRs and all the supporting business performance documents in a cross-functional workgroup? Was it listening to earnings calls and reading valuation memorandums? How about reading P&Ls until my eyes watered? (sorry I realize this sounds cringy and obnoxious, I’m just reinforcing the work it took to upskill.)

One person’s knowledge isn’t enough for collective success.

It wasn’t one of them. It was the power of all of them combined. I also really believe the secret sauce was NETWORKING LIKE CRAZY throughout. All of the academic learning came alive when I could chat with a diverse group of finance and business management contacts – or fellow novices also upskilling. Businesses are a collection of people who align around a mission and goals. One person’s knowledge isn’t enough for collective success.

The point is, there is so much to learn from the people around you. Don’t miss an opportunity to be vulnerable and seek guidance from all the SMEs in your life.

How apropos, in all my love of networking, I was seated next to Alex D. Tremble, the author of ‘Relationships That Work: 4 Simple Steps to Building Intentional Connections in Business and in Life‘ at a conference. I’ll quote something from Chapter 09 of his book. “Becoming a great networker allows you to solve problems and attain the relationships that can assist you in growing personally as well as professionally.” Yep, nailed it.

I think so much of this networking aspect that I need to double down on it. I don’t want to just vaguely throw out the importance of networking. I’m going to give you tons of real-life examples of how I did this

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

5. Apply Your Learns Along the Way and Let Others Know What You’re Working On

This step is the crème de la crème of the secret sauce. There’s no shame in sharing that the sauce is made up of many different recipes given by others who were willing to share – then you put your own signature on it. Ya gotta give credit and gratitude along the way. How cryptic – sorry – back to Finance Literacy Advancement Training (FLAT). In Step 4, I mentioned there is so much to learn from the people around you. Don’t miss an opportunity to be vulnerable and seek guidance from all the SMEs in your life. I promised to show what that looked like for me with real-world examples so here goes:

- Buddy System: When I enrolled in the certificate program, I did it with a co-worker. At first, we’d lament over the unfamiliar finance terms; towards the end, we debated P&L drivers and case study observations. She made the whole thing more enjoyable and productive.

- Network Groups: When the program offered a Facebook group – I joined, connected, and engaged (fast forward a few years and I’ve helped 2 people from that cohort with their new job – it’s how the world often works.)

- Meeting Follow-Ups: When I attended an earnings call, I took notes and drafted questions. Then I scheduled a meeting with our head of investor relations (whom I didn’t know well beforehand but became a wealth of learning for me and a treasured connection). I let him know I was in learning mode, and he was generous with his time to answer my questions.

- Manager 1:1: In every 1:1 with the President of our business (aka, my manager), we’d chat through recent learns. I’d ask all sorts of questions about what’s important to him (a CEO) in his decision-making (constructs that I previously wouldn’t have spent much time thinking about since I was mostly obsessed with ROAS at the time – and I still am BTW). He was very supportive. I’d like to think I’ve made it easy for people to root for me because they know I’m trying to continually better myself and that I’m all in on helping others do the same.

- Ask Questions and Prepare to Listen: When I had a forecast, budget, or investment case to do – I scheduled time with our finance and performance teams (from the CFO and SVP/VPs to the Directors and Managers – every layer of the finance team – yes, all of them). I’d ask how they’d analyze the ROI of a particular decision or project I was working on. I asked them to poke holes in my assumptions. I’d ask how I could better set up the taxonomy to help with easier backend reporting. I took notes, I listened, I applied. BTW, some of those mid-level managers are now senior executives who became my primary stakeholders. It’s a lesson in ALWAYS treating people well. I’ll never forget their patience with me and I’d like to think they’ll always remember my vulnerability as a senior leader.

- Making the Most of Workgroups: When I had to help assemble and analyze QBRs, and all the supporting business performance documents in a super-talented cross-functional workgroup, I’d ask each person’s POV. I had to learn how they interpret their domains and relate them back to financial matters. I’d ask questions. We’d debate assumptions. I’d be wrong a lot about how certain drivers relate. Conversely, sometimes I could spot things that were overlooked. I was engaged, curious, and respectful. Each month I leveled up. We all did. That’s how it goes.

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

Self-reflections and seeking feedback

After every QBR – I’d write my self-reflections of things I would have said differently. Then I’d figure out which of the senior executives on that call was an expert in the thing I botched. I’d immediately reach out and workshop how to approach it better next time. From our Chief Marketing Officer and Head of Legal to our Chief Strategy Officer and all our Business Performance Executives – I put myself out there. You’ll find that nearly everyone is willing to support your growth if you come with the right attitude and display authentic vulnerability (you better have their backs when they need your support as well).

After every QBR – I’d write my self-reflections of things I would have said differently. Then I’d figure out which of the senior executives on that call was an expert in the thing I botched. I’d immediately reach out and workshop how to approach it better next time. From our Chief Marketing Officer and Head of Legal to our Chief Strategy Officer and all our Business Performance Executives – I put myself out there. You’ll find that nearly everyone is willing to support your growth if you come with the right attitude and display authentic vulnerability (you better have their backs when they need your support as well).

If you can’t read my chicken scratch from the above very real notebook I keep for continuous improvement, here’s what I observed in one particular QBR:

- Communication Improvement Area: Get tighter on key points and do not confuse the room with multiple variables. Have 1:1 points and don’t have multiple aspects of a point! Use more simple language vs jargon and get to the dang point quickly

- Better from Prior: Not feeling compelled to answer when I’m not ready. I did better at not answering when I didn’t have enough info to do so re: a question on market response and looming economics which needed more time to formulate a set of hypotheses

Then, when I did it better, I’d take the time to send a thank you note about how that person’s guidance helped me level up. People appreciate and remember things like that. (Your mom was right; send thank yous)

Leverage Your Internal and External Networks

It wasn’t just internal colleagues; I live a few doors down from a retired CFO of a huge organization – I used to try and time my dog walks when he was out just to ask a few finance questions. I was honest about my gaps and upskilling quest, and he would give me nuggets of wisdom.

I’ve also remained in contact with dozens of former business and finance-savvy colleagues who are at new companies now. I continue to learn from diverse views on the factors impacting the EdTech space and all sorts of macroeconomic perspectives – it’s invaluable (disclaimer: I’m of course talking about things that are appropriate to discuss with an external network, not crossing the boundary of confidentiality or sensitive materials). Reaching out over and over and over again to learn from my network has been so invaluable to my professional growth and my ability to drive impact. It’s a symbiotic relationship though. If you ask for time, you should also be willing to give yours. Again, people remember things like this.

Final thoughts on this:

I think there are 3 things that happen when you genuinely engage with people, and they see you working on a skills gap in this way:

- They give you more grace when you botch something (they might even help you fix it)

- They see you in an elevated capacity because you’re someone who is willing to do the work and apply it

- They end up connecting you to future opportunities that can advance your career (how I landed in the role I have today)

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

6. Pay it forward with your new (or old) domain of expertise

Remember alllllll that time others spent with me as I worked through my year-long Project FLAT? There’s a duty to pay that forward. Doing so creates an environment where everyone can grow, innovate, and thrive. It solidifies a leader’s role as both a steward of the company’s current successes and a shepherd guiding its future.

- Giving Back: After benefiting from mentors and experiences during your own journey, sharing your expertise is a way to give back to the community and sectors that shaped you.

- Personal Growth: Teaching and mentoring others can further refine your own understanding of the domain. By articulating complex concepts to someone else, you can often gain new insights yourself.

- Building Stronger Relationships: Sharing expertise helps build deeper, more trusting relationships. It demonstrates that you’re invested in the growth and success of others, which can foster loyalty and camaraderie.

- Broadening Perspectives: Engaging with individuals at different career stages can provide fresh perspectives, helping senior executives stay adaptable and innovative.

PS: just because you master all the finance jargon (or marketing jargon, tech jargon, or whatever your jargon du jour is) does not mean you’ve become an effective communicator, leader, or problem solver in that domain. You have to apply your competencies in practical terms and speak to business operations and financial matters in simple words.

I’ll plug another book Straight Talk Your Way to Success by Dan Veitkus whom I’ve had the pleasure of meeting. It “exposes the difference between spending time, energy, and intellectual firepower trying to sound smart and savvy versus the more effective choice to speak and operate deliberately in order to avoid confusion, frustration, and wasted time to improve productivity”. C’mon, I bet you totally relate to a meeting you sat through riddled with jargon and groupthink without anything productive coming out of it. Are you smiling? Was it earlier today?

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

7. Don’t Stress About The Sunk Cost Fallacy If You Want To Change Course Down The Road

The sunk cost fallacy is our tendency to continue with an endeavor we’ve invested money, effort, or time into—even if the current costs outweigh the benefits. It’s not a phrase I would have thrown out pre-Project FLAT.

Professional development is more than acquiring skills or climbing the career ladder. It’s a personal journey of growth, adaptability, and self-discovery. Yet, many remain anchored by the ‘sunk cost fallacy’, hesitant to pivot due to past investments. For instance, if after extensive financial literacy training, I didn’t directly use those finance concepts daily, it doesn’t negate the value. That journey honed my problem-solving skills, showcased my resilience, expanded my network, and fostered self-awareness. It taught me I can learn new things and it demonstrated that to everyone who watched me on the journey. Life is vast, unpredictable, and full of potential learning experiences. Every course, interaction, and experience, contributes to growth. Embrace the journey, celebrate your evolution, and remain open to the myriad possibilities that lie ahead.

Project F.L.A.T. Download, tweak, and make it your own. Conquer your professional development. I’m your champion rooting you on. You got this!

This Concludes My Deep Dive on Project FLAT

If you’re still reading, thank you! I hope you found value in my real-life professional development plan that took me from a VP of Marketing to an SVP of Operations. For me, Project FLAT wasn’t a sunk cost, but a real catalyst. I didn’t know at the time when I embarked on that professional development plan as a marketer that I’d land at the intersection of opportunity and preparedness to become an executive operator.

Embrace the journey, celebrate your evolution, and remain open to the myriad possibilities that lie ahead.

Obviously, innovation is really important; we all know that. I’m fortunate to work at a company that not only values it as a core principle, but has also built a really legit employee program around it.

Obviously, innovation is really important; we all know that. I’m fortunate to work at a company that not only values it as a core principle, but has also built a really legit employee program around it. This year I was lucky enough to be on the judging panel. ‘Lucky’ because I got to detach from meetings, emails, and memos (awesome) to watch employees at every level, from across the globe, share their ideas to enhance or grow the business that we all work for (super awesome).

This year I was lucky enough to be on the judging panel. ‘Lucky’ because I got to detach from meetings, emails, and memos (awesome) to watch employees at every level, from across the globe, share their ideas to enhance or grow the business that we all work for (super awesome).